The global economy is projected to grow at a slower pace this year than in 2015, with only a modest uptick expected in 2017 according to the OECD. The Outlook warns that a low-growth trap has taken root, as poor growth expectations further depress trade, investment, productivity and wages.

Over the past few years, the rate of global trade growth has halved relative to the pre-crisis period, and it declined further in recent quarters, with the weakness concentrated in Asia. While low investment has played a role, rebalancing in China and a reversal in the development of global value chains could signal permanently lower trade growth, leading to weaker productivity growth. Lack of progress – together with some backtracking – on the opening of global markets to trade has added to the slowdown.

Exceptionally low – and in some cases negative – interest rates are distorting financial markets and raising risks across the financial system. A disconnect between rising bond and equity prices and falling profit and growth expectations, combined with over-heating real estate markets in many countries, increases the vulnerability of investors to a sharp correction in asset prices.

“The marked slowdown in world trade underlines concerns about the robustness of the economy and the difficulties in exiting the low-growth trap,” said OECD Chief Economist Catherine L. Mann. “While weak demand is surely playing a role in the trade slowdown, a lack of political support for trade policies whose benefits could be widely shared is of deep concern.

“Monetary policy is becoming over-burdened. Countries must implement fiscal and structural policy actions to reduce the over-reliance on central banks and ensure opportunity and prosperity for future generations.”

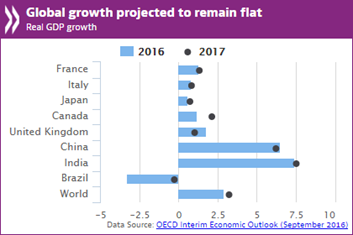

The OECD projects that the global economy will grow by 2.9 percent this year and 3.2 percent in 2017, which is well below long-run averages of around 3¾ percent.

The small downgrade in the global outlook since the previous Economic Outlook in June 2016 reflects downgrades in major advanced economies, notably the United Kingdom for 2017, offset by a gradual improvement in major emerging-market commodity producers.

Growth among the major advanced economies will be subdued. In the United States, where solid consumption and job growth is countered by weak investment, growth is estimated at 1.4 percent this year and 2.1 percent in 2017. The euro area is projected to grow at a 1.5 percent rate in 2016 and a 1.4 percent pace in 2017. Germany is forecast to grow by 1.8 percent in 2016 and 1.5 percent in 2017, France by 1.3 percent in both 2016 and 2017, while Italy will see a 0.8 percent growth rate this year and next.

In the United Kingdom, growth is slowing following the 23 June referendum to leave the European Union. While a strong response from the Bank of England has helped stabilize markets, uncertainty remains extremely high and risks are clearly on the downside. In this environment, the UK is projected to grow by 1.8 percent in 2016 and 1 percent in 2017, well below the pace in recent years.

Growth in Japan will remain weak and uneven, at 0.6 percent in 2016 and 0.7 percent in 2017, with the appreciation of the yen and weak Asian trade weighing on exports. Canadian growth is projected at 1.2 percent this year and 2.3 percent in 2017.

China is expected to continue facing challenges as it rebalances its economy from manufacturing-led demand toward consumption and services. Chinese growth is forecast at 6.5 percent in 2016 and 6.2 percent in 2017. India will continue to grow robustly, by 7.4 percent in 2016 and 7.5 percent in 2017. Despite some improvements, Brazil’s economy continues experiencing a deep recession, and is expected to shrink by 3.3 percent this year and a further 0.3 percent in 2017.

The Interim Economic Outlook renews calls for a stronger collective response using fiscal, structural and trade policies to boost growth. On the fiscal front, low interest rates offer governments additional fiscal space for investing in human capital and physical infrastructure to promote short-term demand, long-term output and inclusiveness.

On the structural side, more ambitious policies are needed, particularly those that boost trade, including commitments to stand still on new protectionist measures, roll back existing ones and urgently tackle other obstacles to trade and investment.